|

Visit www.floridabar.org/rules/ctproc/ to view Notice

of Appeal forms under section 9.900. Recreate the Notice of Appeal and any additional forms relevant to your

case. Additional standard appeal forms are also available, i.e., Directions to Clerk, Designation to Court

Reporter. Submit the notice of appeal to the Clerk. Except in criminal cases, a conformed copy of the

order(s) designated in the notice of appeal shall be attached to the notice together with any order entered

on a timely motion postponing rendition of the order(s) appealed 9.110 (d). The notice of appeal must be

filed with appropriate filing fee or application for indigent status at time of filing. No personal checks

are accepted. For assistance with filing county to circuit appeals, please download the Administrative Order 2020-16 Amended by visiting www.circuit19.org/sites/default/files/2020-10/2020-16.pdf.

For assistance completing legal documents, you may find/search for an attorney going to www.floridabar.org/directories/find-mbr/

Appeals FAQ

|

|

Visit www.floridabar.org/rules/ctproc/

Appeals FAQ

|

|

Visit our website at https://stlucieclerk.gov/fees#appeals for list of fees.

Appeals FAQ

|

|

You may do one of the following:

- Hire an attorney to file contempt papers on your behalf.

- Hire the Florida Department of

Revenue, Child Support Enforcement Office.

- Download a Motion

for Contempt packet online from the Forms page or in person from the Family Relations

Division in the Clerk's office and represent yourself.

Child Support FAQ

|

|

All child support case payments are now processed through the State Disbursement Unit.

Child Support FAQ

|

|

Yes, fill out the direct deposit form and attach a voided check or savings account deposit slip and mail to the address on the form. This form is only for cases not enforced by the Department of Revenue/Child Support Enforcement.

Child Support FAQ

|

|

Yes, go to to Florida Department of

Revenue, Child Support Enforcement Office and follow the instructions provided with the form.

Child Support FAQ

|

|

Florida State Disbursement Unit

P.O. Box 8500

Tallahassee, FL 32314-8500

You may also make payments online at My Florida County.

Child Support FAQ

|

|

The Family Relations Department is unable to take regular monthly child support payments. Only lump sum purge

payments can be received and processed.

If you would like to make a regular support

payment, please use one of the following:

PAY ONLINE AT:

www.myfloridacounty.com Click on “Child Support “and choose what you want

to do. You can use your credit card or have it electronically debited from your checking account.

fl.smartchildsupport.com Go to the website and follow the

directions.

PAY BY CASH:

For cash payments, you may send a MoneyGram.

Select the Bill Pay form

Company

Name: My Florida County

Receive Code: 14694

Account number: enter 56 followed by 11 digit case

number

PAY BY MAIL:

You can send your personal check, money order or bank check to the

following address:

State of Florida Disbursement Unit

P.O. Box 8500

Tallahassee, FL 32314-8500

Include the following information:

Your full name, case

number, county name, and social security number.

For Payment inquiry or Address Change: Call SDU Hotline: 1-877-769-0251

For Enforcement of your court order, establish paternity, or help locating absent parent: Call FL

Dept. of Revenue Child Support Enforcement: 1-850-488-5437, online: www.floridarevenue.com or visit them at: 337 N. US HWY 1, Ste.

C, Ft. Pierce, FL 34950

Child Support FAQ

|

|

- You can call 877-769-0251, 24 hrs a day, 7 days a week. You will need your case number and social

security number.

- You may access the information at My Florida County.

Child Support FAQ

|

|

All payments should include:

- Case number

- St. Lucie County

- Custodial Parent name

- Non-custodial parent name

- Social security number of the non-custodial parent

Child Support FAQ

|

|

Yes. All checks should include a distribution list with case number, county, custodial and non-custodial

parent names, social security number of the non-custodial parent, and how much money is allotted to each

case.

Child Support FAQ

|

|

All Department of Revenue Cases DO NOT pay a fee to the Clerk. All private cases DO pay a fee to the

Clerk.

Child Support FAQ

|

|

The Clerk fee is 4% of the payment, up to $5.25.

Child Support FAQ

|

|

Call the Department of Revenue, which is located at 337 North U.S. Highway 1, Suite C, Fort Pierce, FL

34950. They can be reached through the customer service toll free number at 850-488-5437 or go to

Florida Department of Revenue,

Child Support Enforcement Office to apply for services.

Child Support FAQ

|

|

Driver licenses are suspended through the Florida Department of Revenue. To reinstate a suspended

license, you will need to visit the local Florida Department of Revenue office at 337 North U.S. Highway

1, Suite C, Fort Pierce, FL 34950. They can be reached through the customer service toll free number at

850-488-5437. You may also download a Petition

to Reinstate Driver License or file a Petition

to Contest DOR Notice of Intent to Suspend Driver License (available for download on the Forms

page).

Child Support FAQ

|

|

You may receive less than what is paid because the Florida Department of Revenue collects money for the

payback of AFDC (Aid for Dependent Children) along with child support payments. If you feel that they

should not be collecting for the AFDC reimbursement, you will need to contact the Florida Department of

Revenue customer service toll-free number at 850-488-5437, or visit their office located at 337 North

U.S. Highway 1, Suite C, Fort Pierce, FL 34950.

Child Support FAQ

|

|

You may purchase a payment history from the Family Relations Department located at the Clerk's Main

Office, 201 S. Indian River Drive, 2nd Floor, Fort Pierce, FL 34950. Copies are $1/page and range from

1-20 pages depending on the amount of payments made. For more information, call 772-462-6910.

To request a payment history through the mail, you will need to call the Support Division of the County

Courthouse at 772-462-2835 to find out how many pages you will need to pay for. You will then send a

money order, payable to the Clerk and Comptroller, St. Lucie County, along with a self-addressed stamped

envelope with a request for a case history to the Clerk and Comptroller, St. Lucie County, Child Support

Division, P.O. Box 700, Fort Pierce, FL 34954

Child Support FAQ

|

|

To register your new address, please call the Florida State Disbursement Unit at 877-769-0251 and follow

the prompts. Choose the "address change" option and enter your new address. To register your new address

with the Clerk's office, please complete the

Change of Address

form and return it to our office. The new

address will then be updated in our system.

Child Support FAQ

|

|

Yes. $5.00 for the first page, and $4.00 for each additional page.

Circuit Civil FAQ

|

|

The Sheriff's Department charges $40.00 for each summons.

Circuit Civil FAQ

|

|

The Clerk’s Office has no control over this. It is up to the attorney(s) and/or parties involved in the

case as to how fast the case is finished.

Circuit Civil FAQ

|

|

Yes.

Circuit Civil FAQ

|

|

No, the judge may only hear you at the times of hearing on the motions presented to him/her. You may

write a letter and file it into the court file, but you are responsible for making sure all parties

involved receive a copy of the letter.

Circuit Civil FAQ

|

|

Yes, the recording fee is $10 for the first page and $8.50 for each additional page. Also, there is an

indexing fee of $1 per name after the first four names.

Circuit Civil FAQ

|

|

The civil cover sheet and summons forms are available on the Forms page. All other forms must be

prepared yourself. The Clerk’s office is prohibited from offering legal advice. If you need assistance,

please speak with an attorney.

Circuit Civil FAQ

|

|

They are held at the Clerk’s St. Lucie West branch, located in the

South

County Courthouse Annex, 250 N.W. Country Club Drive, Port St. Lucie.

County Civil FAQ

|

|

Yes, the recording fee is $5 for the first page and $4 for each additional page. In addition, there is

an indexing fee of $1 per name after the first four names.

County Civil FAQ

|

|

Yes, the recording fee is $10 for the first page and $8.50 for each additional page. In addition, there

is an indexing fee of $1 per name after the first four names.

County Civil FAQ

|

|

They charge $40 per summons. The payment must be separate from other fees.

County Civil FAQ

|

|

We have Eviction packets available for you to review on our website or in person. You may file in person, mail in your filings or file through the Florida E-portal System. (Note: provide instructions on how to establish a self-represented litigant account)

To evict someone living in your home (friend or family member), you would use the Unlawful Detainer form found under County Civil > General Forms. (Evictions are for Landlord/Tenant scenarios, for which there are five.)

County Civil FAQ

|

|

There are no forms for County Civil cases. You must prepare all forms yourself or seek legal advice.

County Civil FAQ

|

|

If the defendant has not been served with your complaint, your hearing date will be canceled. Your case

will remain open for a period of six months to provide you with time to locate the defendant and provide

the court with another address for service. It’s important to know that the defendant is at the address

you supply prior to filing your complaint. Filing fees are non-refundable and the Sheriff’s Office

cannot locate the defendant for you.

County Civil FAQ

|

|

At the time of filing, you may provide the court with a self-addressed, stamped envelope which would be

forwarded to the Sheriff along with your documents for service. If an envelope is provided, the Sheriff

will forward you a copy of their return of service. You may wish to contact the Clerk’s office prior to

appearing for the hearing to verify that service was issued.

County Civil FAQ

|

|

The Clerk’s office charges a statutory $10 per defendant summons issuance fee. In addition, if you use

the Sheriff’s Office for service, they will charge $40 to attempt service at another location.

County Civil FAQ

|

|

Yes, even though attorneys are not required in small claims court, you or the opposing party may hire an

attorney.

County Civil FAQ

|

|

$50.00 after case has been close on a final judgment or order for more than 90 days.

County Civil FAQ

|

|

In order to request a record to be expunged or sealed, you must first apply through F.D.L.E. (Florida

Department of Law Enforcement) to obtain a Certificate of Eligibility. Visit the Florida Department of

Law Enforcement site to obtain the application and instructions. Note: You will need a certified

disposition of your case from the Clerk when submitting your application.

After obtaining a Certificate of Eligibility from F.D.L.E., you may file your Petition and supporting

documents with the Clerk along with paying your filing fee. In addition, you may be required to obtain a

court date to go before the judge.

Criminal FAQ

|

|

An arraignment is a court date at which the defendant is advised of charges against him or her. A plea

of not guilty or guilty is entered. The court also addresses the defendant's ability to obtain an

attorney.

Criminal FAQ

|

|

The cost for a criminal record search is $1.00 for each year to be searched, $1.00 for each copy, and

$2.00 for certification.

Criminal FAQ

|

|

No, the clerks are record keepers only. Any legal advice must be obtained by contacting an attorney.

Criminal FAQ

|

|

Sentences imposed for criminal offenses can vary from paying a fine, probation, community control,

jail/prison time or a combination of such.

Criminal FAQ

|

|

If you fail to appear for court, the Judge may issue a bench warrant for your arrest. You may contact

the Judge’s office in the event you fail to appear. Contact information for each Judge in the 19th

Judicial Circuit can be found at http://circuit19.org. Any

motions or pleadings you file

before the

court must include your name, current address, phone number, and case number.

Criminal FAQ

|

|

Only the Judge has the authority to reset or excuse you from a court appearance in a criminal case.

Contact

information for each Judge in the 19th Judicial Circuit can be found at http://circuit19.org.

Criminal FAQ

|

|

A Nolle Prosequi / No Information means that the State Attorney declines to prosecute but may still

initiate prosecution within one year.

Criminal FAQ

|

|

Transcriptions can be obtained through Digital Court Reporting. Their instructions and request form are on their website: http://www.circuit19.org/programs-services/forms/transcript-request-form. If you need to reach them by phone their number is 772-807-4370.

Criminal FAQ

|

|

Please review the FAQ’s listed on the circuit website, http://www.circuit19.org/programs-services/court-programs/court-interpreters/faqs.

Criminal FAQ

|

|

The online link/form is http://www.circuit19.org/programs-services/court-programs/court-interpreters/sign-language-interpreter-requestcancellation or contact court administration at (772) 807-4370.

Criminal FAQ

|

|

If you are arrested or charged with a crime, the charges will reflect on your record indefinitely even

if the court dismisses the charges or the state attorney decides not to prosecute by filing a nolle

prosequi or no information. A case has to be expunged to be permanently removed from your record.

Criminal FAQ

|

|

You may obtain a copy of an Official Record Book on CD for a fee, plus postage if you want it mailed.

Digital Imaging FAQ

|

|

You need to know either the subdivision name or the Plat Book and page number of the plat. If it is a

multi page plat and you only need a specific lot and block, you need to provide us with that lot and

block number.

Digital Imaging FAQ

|

|

The entire list of recorded plats is available for purchase on multiple CD's. You may purchase any one

or the complete set of discs. Currently there is a fee per disc. They are updated quarterly. Until they

are updated on CD, the most recent plats are viewable through the online search system.

Digital Imaging FAQ

|

|

The images on the Official Record Book and the Plat CD's are tiff files. They should work on any

computer that has an image viewing program.

Digital Imaging FAQ

|

|

You can order plats either by phone or by mail. There is a fee per page, plus postage. Contact the

Research Department at 772-462-6930 for ordering instructions.

Digital Imaging FAQ

|

|

No. We began the switch from filming to scanning in 2004. Now all records are scanned. We have the

ability to generate microfilm of any digital image through the use of a Kodak Archive Writer, which has

the ability to put digital images on microfilm guaranteed to last 500 years.

Digital Imaging FAQ

|

|

Were the natural parents of the child or children ever married?

- If you answer YES: You may download the Petition

for Dissolution of marriage. Please ensure that you

read the instructions to make sure you fill out the correct packet specific to your situation.

- If you answer NO: You may download the

Petition to Determine Paternity form and when you are ready

to file, the filing fee prices and packet costs are listed on our fees page. ALL FEES MUST BE PAID IN

CASH, MONEY ORDER, PERSONAL CHECK, ATTORNEY CHECK or CREDIT CARD (AMERICAN EXPRESS, MASTER CARD,

VISA or

DISCOVER). Make checks payable to: Clerk and Comptroller, St. Lucie County. Please write your

telephone

number and driver license number on the check. Credit card payments incur an additional fee.

Divorce FAQ

|

|

Please visit our Public Records

Request page to request a copy.

Divorce FAQ

|

|

Yes. Legal Aid Service in St. Lucie County is available by contacting:

Florida Rural Legal Services

510 South U.S. Highway 1, Suite 1

Fort Pierce, FL 34950

772-466-4766

www.frls.org

Divorce FAQ

|

|

Download a list of

providers from the Florida Department of Children and Families website.

Divorce FAQ

|

|

You need to state whether you agree or disagree with the allegations in the petition that you were

served. The

Answer forms are available on the Florida Courts website. Your original response must be

filed with the Clerk's office. You need to make sure that you keep a copy for your records and you must

send a copy to the other party and/or their attorney.

Divorce FAQ

|

|

You will be assigned a court date once all of your papers have been completed and filed.

-

If you have served the other party via Summons, the Family Relations Department must have the

Original

Summons and the Return of Service filed. The person that was served the documents has a total of 25

days

to respond to the court in writing. This 25-day period begins the day after the party is served and

will

last until 5:00 p.m. on the 25th day. If that person does not respond within the time frame, you

will

need to file a Non-Military Affidavit, Motion for Default and a Default with the court, and you will

then be able to request a court date by going to the Circuit 19

website and filling out a Form A.

Divorce FAQ

|

|

The deputy clerk professionals cannot assist you with filling out forms. You may contact an attorney or

Florida Rural Legal Service for assistance.

Divorce FAQ

|

|

You cannot get your money back. All of our fees, including the filing fees are non-refundable.

Divorce FAQ

|

|

It is always in your best interest to attend a hearing in person. If you CAN NOT attend, you MUST file a

motion to

appear by phone. That motion will be forwarded to the Judge hearing your case and an order

will be issued Granting or Denying your motion.

Divorce FAQ

|

|

If you do not have the money to pay the filing fee(s) for the case, you may complete an Application for

Determination of Civil Indigent Status. The application is available in the Family Relations

Department,

and there is no fee for the form or to have it reviewed by a Clerk representative. If you are determined

to be indigent, the filing fee(s) are waived.

Divorce FAQ

|

|

$30.00 in person

Divorce FAQ

|

|

No, there is no filing fee required.

Domestic Violence FAQ

|

|

The Petitioner must have a photo I.D.

Domestic Violence FAQ

|

|

The Petitioner will be in our office approximately 45 minutes to an hour filling out the paperwork.

Domestic Violence FAQ

|

|

No, it must be remembered that the clerks who work in the Domestic Violence Division are not attorneys.

Therefore, they are not able to give legal advice or answer any legal questions. An attorney must be

consulted for all legal matters.

Domestic Violence FAQ

|

|

No, there is no fee if papers are served in the State of Florida.

Domestic Violence FAQ

|

|

ONLY if there's a temporary injunction or an order setting hearing.

Domestic Violence FAQ

|

|

It is not mandatory to have an attorney at the hearing. It is totally up to the petitioner as to whether

they want to bring one to represent them.

Domestic Violence FAQ

|

|

On the internet, go to www.myflcourtaccess.com. Once

there, you may want to add the site to your

“Favorites” so you can easily get back to it. You will see the “Register” button at the top.

Instructions are easy to follow for setting up your registration, user name and password. If you wish

for more assistance, there are a number of videos available on the Florida Courts E-Filing

Authority

website that can help you with many of the tasks, including initial registration.

The Florida Bar member database is used to validate who you are when signing on. The system recognizes

your Bar i.d. and the name that you have registered with The Bar. So, if you sign on as Bill Porter, and

your registered Bar name is William Porter, the portal will reject the registration. So, make sure you

do not mis-type your name or Bar i.d.

E-File FAQ

|

|

There is no cost to register. Once you register, you may file in all state courts in Florida.

However, the statutory filing fees still apply so if you are submitting a new case, or a document that

requires a fee, there will be a filing fee required in order to submit your document for filing and a

statutory convenience fee based on the payment method.

E-File FAQ

|

|

If you registered from the portal homepage, www.myflcourtaccess.com, you need to look for two emails

sent to the email account you provided. The emails will be from [email protected]. The first

email acknowledges that you have successfully registered. The second email asks you to click on a link

embedded in the body of the email. This link “activates” your account. Until you click through on this

link, you cannot log into the portal from the home page. The link will take you to a page where can log

in for the first time. Please make sure to write down your username and password for your records.

E-File FAQ

|

|

The Florida Courts E-Filing Portal accepts Discover, MasterCard, Visa and American Express. The

following convenience fees are established.

- Credit Cards = 3.5% of Filing Fee

- ACH = $5 flat rate

The portal generates a receipt that is emailed to the filer when he or she files a document and it is

accepted by the Clerk’s Office. That email message contains a number called the filing reference number,

or

“filing i.d.” That filing i.d. will show up on the credit card receipts and, by mid-year, will appear on

bank statements as well. The following shows the numbering convention and several examples of how it

will be

presented.

“ePortal”+{8 digit filing id}+{space}+{6 character memo}

Samples from a statement:

ePortal822539 R Link

ePortal824252

ePortal826277 091644

Please note: the credit card or bank account is not charged for the filing until the Clerk accepts the

filing.

E-File FAQ

|

|

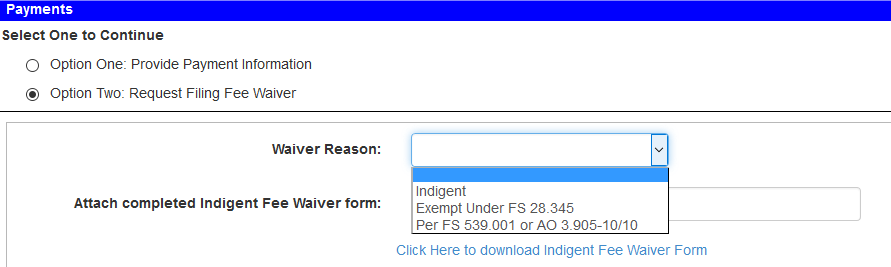

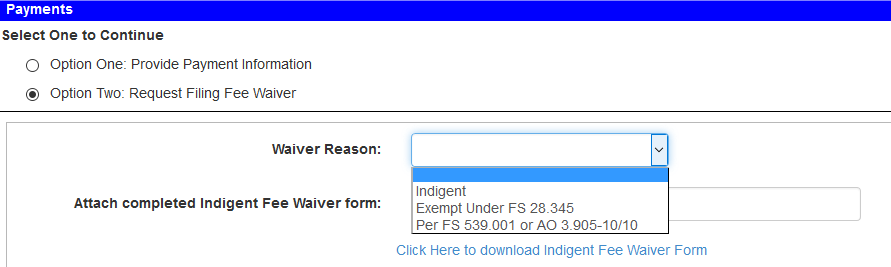

There are two options for having filing fees waived:

Option 1 – On the Fees and Payments page:

- Request Fee Waiver

- Select Waiver Reason

- Attach Waiver Form

Option 2 – Request to have a “law firm account” established. These type accounts can be set up to waive

filing fees for all users affiliated with the account. This type account is an organizational account,

not exclusive to private firms, and may be utilized by state agencies, state attorneys, public

defenders, and other public entity organizations that are eligible according to s. 28.345, F.S.

An authorized organizational representative should contact their local Clerk’s office and request to

have a Law Firm account established for their organization. Please refer to the Organization

Administrator User Guide on the Florida Courts E-Filing Authority website for details on

managing

the

law firm account and its affiliated users.

Please note that, if an attorney files case on behalf of both a public entity (fees waived) and private

clients (fees not waived), they may not be affiliated with a law firm account that has fees universally

waived. Those attorneys would have to utilize option 1 above when filing on behalf of public entity

clients and pay the fees when filing on behalf of private clients.

E-File FAQ

|

|

Each year Florida Courts E-Filing Portal has been audited for financial security and received no

comments. Those audits are posted on the authority website, Florida Courts E-filing

Portal. Further, the

portal was built to industry fraud standards using PCI compliance and the financial controls are

monitored constantly.

Debit block services protect your bank accounts from unauthorized electronic charges. The block (or

filter) provides stringent control over electronic transactions posted to bank accounts. Your bank will

only process authorized transactions. Check with your bank before setting up a debit payment. If you

have a debit block on your bank account, you must provide certain information to your bank so it can

process your payments.

E-File FAQ

|

|

No, the only requirement will be an internet connection and a browser. If you are able to send and

receive email with attached documents, and use a fairly new computer — the portal supports Internet

Explorer 11 or higher — you probably already know how to navigate your computer to attach a text or PDF

document as you file on the Florida Courts E-Filing Portal. Use a personal computer when filing as the

portal does not currently accept documents sent from an iPad or an Android device.

Please note: a document must be sent through the portal. Sending a document by email to the Clerk's

office or to MyFlCourtAccess.com does not get it filed or edited.

E-File FAQ

|

|

The Florida Courts E-Filing Portal will accept filings in Word, Word Perfect, or PDF formats. By

default, the ePortal will convert a WORD or Word Perfect document and provide it in PDF format to the

local record system. The preferred format is PDF/A. This format will be required by June, 2021.

E-File FAQ

|

|

As defined in Rules of Judicial Administration 2.520:

- 8 ½ x 11 inches

- Portrait orientation

- 300 DPI [for a scanned document]

- Black and white not color [for a scanned document]

- 3 x 3 inch space at the top right-hand corner on the first page

- 1 x 3 inch space at the top right-hand corner on each subsequent page

- 1 inch margin

- Do not password protect your documents

Multiple pleadings, motions, etc. should not be combined into one single file; each individual document

should be uploaded via the Portal document submission process.

A deviation from these guidelines may result in the submitted filing being moved to a Pending Queue with

the

filer being notified via email and requested to correct the issue(s) with the document(s) and resubmit

the

filing.

The Document submission standards are posted on the Florida

Courts E-Filing Authority website.

E-File FAQ

|

|

The Appellate Court Technology Committee has approved and the Florida Court Technology Commission has

been informed of the Document

Binary File Name Standards for e-filing and e-recording. Please be aware

that certain naming conventions do not transmit through the portal without error.

E-File FAQ

|

|

The Supreme Court requires that documents submitted electronically to the Florida State Courts System

must be ADA complaint. For more information about how to make your documents complaint, visit the

Supreme Court Accessibility page.

E-File FAQ

|

|

Filings, which can be comprised of multiple documents, are limited to 50 megabytes in size. This also

applies to a total size when adding more than one document—the sizes as added together cannot exceed 50

megabytes for one submission.

If you have an oversize document or filing, Please file one page with wording “Request oversize document

filing” and include email information. Our IT department will send instructions for filing the

document(s).

E-File FAQ

|

|

The filer must check the documents that are being filed for confidential information. If you are filing

a document with confidential information, you must attach a Notice of Confidential Information within

the court filing as per rule 2.420, Rule of Judicial Administration. The form is posted on the e-filing

site, right below where you add a document.

E-File FAQ

|

|

The ePortal supports electronic signatures as defined in AO 09-30:

A pleading or other document is not required to bear the electronic image of the handwritten signature

or an encrypted signature of the filer, but may be signed in the following manner when electronically

filed through a registered user’s login and password.

- s/ John Doe

- John Doe (e-mail address)

- Bar Number 12345

- Attorney for (Plaintiff/Defendant)

- XYZ Company

- ABC Law Firm

- 123 South Street Orlando, FL 32800

- Telephone: (407) 123-4567

Verified and sworn documents and original paper judgments and sentences may be filed electronically but

must

also be deposited with the Clerk’s office in paper format.

E-File FAQ

|

|

The Clerk’s Office has the ability to add items to the drop-down menus. You will need to call the

clerk’s office in the county in which you are filing so they can add that option in the party drop-down.

E-File FAQ

|

|

You will receive an automated filing confirmation, in the email account you provided through your portal

email, both when the portal receives the filing and also when the Clerk’s Office accepts the filing.

Also watch for information on the “My Trial Court Filings” portion of your portal account when you

logon. The time and date that is given when the portal receives the document, the note shows,

“Submitted.”

Once the Clerk begins review at the local level, you will see the notation, “Pending Review.” The

submission is in the list for the Clerk to review. In the event there are issues with the document, you

may see the term, “Pending Queue.” At that point, the filer has 5 days to correct the issue with the

document or it will be sent to the “Abandoned Queue.” If the document has been placed in the pending

queue, there should be some direction by the clerk as to what needs corrected. Please review the E-Filer

Manual for the exact steps on how to edit the document for re-submission.

Once the filing is accepted into the local Clerk’s system, this becomes the official court record just

like the current paper process. As a precaution, make sure you have sent the filing to the correct

county to make sure it is timely filed.

E-File FAQ

|

|

The best way to file exhibits is to create them as separate documents. Name them the same, but append

the words: “Part 1 of 4,” “Part 2 of 4,” and the like, so the Clerk can tell the documents go together.

Currently, several counties require the exhibits to be part of the main document; i.e., all in one

document.

E-File FAQ

|

|

There are a number of documents, instructional videos and materials posted on the Florida Courts

E-Filing Authority website. Additionally, there is an e-filer manual found in the Filer

Documentation

link once you are on the portal. Once logged in to the portal, scroll to the bottom of the

screen.

More information can also be found on the Supreme Court’s E-Filing

page.

You may also visit The

Florida Bar E-filing resources page.

E-File FAQ

|

|

Yes, check the Foreclosure Sales Calendar.

Foreclosure FAQ

|

|

Yes.

Foreclosure FAQ

|

|

No, the Clerk needs either the name of one of the parties or the case number associated with the

foreclosure. If that information is not available to you, you may call the Property Appraiser's Office

(located at 2300 Virginia Avenue, Ft. Pierce, FL) and give them the street address. They can look up the

owner's name for you.

Foreclosure FAQ

|

|

No, you can obtain the name and address of the owner from the Property Appraiser's Office at 2300

Virginia Avenue, Ft. Pierce, FL.

Foreclosure FAQ

|

|

Foreclosure sales are held online at Foreclosure FAQ

|

|

Bidding begins at 8:00 A.M.

Foreclosure FAQ

|

|

Clicking the plus (+) sign next to the case number will reveal a link to the final judgment in the St.

Lucie County Official Records website. The final judgment usually has the address on the 2nd or 3rd

page. Use that address to look up the property on the Property

Appraiser's website to obtain further

information. You may also visit the Tax Collector's website and the

Clerk's free online database of St.

Lucie County's Official Records to learn more about the property.

Neither the auction site nor the Clerk's Office provides property information. It is your responsibility

to do all the independent research regarding the property, including but not limited to, determining the

property value and whether there are any liens, encumbrances or title defects.

Foreclosure FAQ

|

|

No. You must do your own research regarding the properties on which you wish to bid.

Foreclosure FAQ

|

|

Advance deposits may be made online through the electronic auction website via ACH/Electronic Debit

transfer. In addition, the deposit may be paid by cash, official bank check, cashier's check, and if

represented by an attorney, by attorney trust account check (clearly delineated as such on the

check).

Final payment must be made by cash, cashier's check, or wire transfer. In order to cover wire

transaction fees, the Clerk requires an additional $5.75 ($5.00 for wire fee and $.75 for postage) to be

included in the total amount due. The sale will be forfeited if the full amount is not received. Final

payment must be received by the Clerk's bank by the 2 p.m. deadline the business day following the sale.

If you are a plaintiff representative and have not bid above your credit limit you may make final

payment through the E-Portal.

Foreclosure FAQ

|

|

The title will be issued on the eleventh day after the sale. If the eleventh day falls on a weekend or

holiday, then the title will be issued on the next business day.

Foreclosure FAQ

|

|

The Title cannot be issued until the Judge reviews the objection and files an Order directing the Clerk

to issue the Title or cancel the Sale and Bid.

Foreclosure FAQ

|

|

No. The Clerks are not qualified to answer any legal questions. For legal questions, please consult an

Attorney.

Foreclosure FAQ

|

|

Auctions are held on properties offered for sale to the highest bidder. The Clerk’s Office conducts the sale via public auction on the Internet in accordance with Florida Statutes. The property or interest being auctioned may be worth less than the assessed value.

Anyone may bid on the properties. All bidders must register online prior to the sale. The site provides information for each sale item, including the name of the owner and legal description.

At the date and time specified for the sale, each item is auctioned in order of case number and sold to the highest bidder.

Prior to the time of the sale, the successful high bidder must post with the Clerk’s Office a nonrefundable deposit of 5% of the anticipated high bid for each item on which a bid is placed. The bidder must pay the balance of the final bid plus the court registry fee (3% of the first $500 and each subsequent $100 at 1.5%) by 2:00 PM ET the next business day following the sale.

You may pay the deposit in person at 201 South Indian River Drive Circuit Civil, 2nd Floor, Fort Pierce, Florida 34950 or 2300 Virginia Avenue, Fort Pierce, Florida 34982 in the form of cash or cashier’s check made payable to St. Lucie Clerk of the Circuit Court. Advance deposits in person must be made by 4:00 PM ET the day prior to the sale. Upon payment of the remainder of the bid in cash or wire transfer, with proof of publication filed with the Clerk, the Clerk will issue a Certificate of Sale.

A Certificate of Title may be issued by the Clerk of the Circuit Court after ten (10) full days have elapsed from the issuance of the Certificate of Sale and provided there is no other action relating to the subject proceeding.

Foreclosure FAQ

|

|

Property owners are required to pay property taxes on an annual basis to the County Tax Collector. If

the owner does not pay his/her taxes, in June of the following year a tax certificate will be sold by

the Tax Collector.

Generally, if the tax certificate has not been redeemed within two years, the holder of the certificate

can apply to force a public auction of the property. This auction is referred to as a "tax deed sale"

and the monies collected from the sale are used to pay off the amount owed to the certificate

holder.

The Clerk holds tax deed sales pursuant to Florida Statute Chapter 197.

Foreclosure & Tax Deed Auction FAQ

|

|

Clicking the plus (+) sign next to the tax deed file number will take you to a parcel number that links

to

the Property Appraiser's website, displaying property address and other information. You may also visit

the

Tax Collector's website and the Clerk's free online database of St. Lucie County's Official Records to see

what you can learn about the property.

Neither the auction site nor Clerk's Office provide property information. It is your responsibility to

do

all the independent research regarding the property, including but not limited to, determining the

property

value and whether there are any liens, encumbrances or title defects.

Foreclosure & Tax Deed Auction FAQ

|

|

An online tax deed sale is an auction where bids are transmitted and received electronically through the

internet using a computer and a web browser. Florida Statute 197.542(4)(a) authorizes the Clerk to

conduct electronic tax deed sales.

Foreclosure & Tax Deed Auction FAQ

|

|

Prior to online tax deed sales, bidders congregated in a large crowded room in the courthouse and called

out their bids to an auctioneer. Online sales allow this process to be handled electronically. Each

bidder will use a personal ID and password to log on to the website and enter bids for individual

properties.

Foreclosure & Tax Deed Auction FAQ

|

|

A bidder must have internet access and a web browser; recommended browsers include: Internet Explorer

version 6.0 or later, Mozilla Firefox version 3.0 or later.

Foreclosure & Tax Deed Auction FAQ

|

|

Registration on the website is free. However, you will need to abide by the Clerk's deposit rules. See

FAQ #15 on how to submit a deposit.

Foreclosure & Tax Deed Auction FAQ

|

|

Representatives of Real Auction are available (on their website) or via phone at (877)

274-9320

between 8:00 a.m. and 5:00 p.m. EST on business days to provide instruction and answer questions

regarding use of the website.

Foreclosure & Tax Deed Auction FAQ

|

|

Please contact the Tax Collector's office at (772) 462-1650 between 9:00 A.M. and 5:00 P.M. EST on

business days.

Foreclosure & Tax Deed Auction FAQ

|

|

NOTE: THE PROPERTY CAN BE REDEEMED AT ANYTIME BEFORE THE FINAL PAYMENT IS RECEIVED BY THE CLERK. Upon

receipt of final payment, the Clerk will issue and record a tax deed to the successful bidder. The

original tax deed will be mailed via first class mail, U.S. Postal Service to the successful bidder at

his/her address as shown in the Tax Deed.

Foreclosure & Tax Deed Auction FAQ

|

|

Some liens may be dischargeable and others may not. Tax and property laws are complicated and bidders

should thoroughly research outstanding or potential liens, mortgages, encumbrances or title defects

prior to placing a bid on a property in a tax deed sale. It is best to seek legal advice of an attorney

who can provide you with information about liens on a given property. Be advised that you are solely

responsible for researching tax deed properties and you assume sole responsibility for making any bid at

the online tax deed sale. The Clerk's Office does not make any representations or warranties as to the

status of the title or liens on property auctioned at a tax deed sale.

Foreclosure & Tax Deed Auction FAQ

|

|

- Register on the website

- Review the recorded Demo on the Home page

- Read the Tax Deed Instructions documents

- Submit the required deposit with the Clerk

Foreclosure & Tax Deed Auction FAQ

|

|

All bidders may begin placing bids at 8:00 a.m. on the scheduled day of the sale. Refer to the auction

calendar for upcoming sales.

Foreclosure & Tax Deed Auction FAQ

|

|

Proxy bidding is a form of competitive sale in which bidders input the maximum bid they are willing to

pay for a property they would like to purchase. The system will then automatically enter bids on their

behalf, as necessary, up to their maximum bid.

Foreclosure & Tax Deed Auction FAQ

|

|

If a bidder becomes a leading bidder (as displayed by "leader" in the bid status column) in the last one

minute of the sale, the Auction Clock will change to reflect a new Auction Close Time and the sale will

be extended one (1) minute to allow additional bidding. This will continue until that bidder remains

leader for one (1) minute (at which time the auction closes and the leading bid becomes the Winning

Bid). Be aware that submitting a bid higher than the "best bid" may not trigger overtime due to the

automatic proxy bid. The bid you submit must make you the "leader" in order to trigger overtime. When

you submit your bid you will get a message on your screen that indicates your bid has been accepted and

your status is now leading or you are now trailing.

Foreclosure & Tax Deed Auction FAQ

|

|

Advance deposits may be made online through the electronic auction website via ACH/Electronic Debit or

you may submit your deposit directly to the Clerk's Tax Deed department.

If you submit your deposit via ACH/Electronic Debit, it must be submitted at least three (3) full

business days before the auction in which you intend to participate. Funds will clear on the fourth

(4th) business day, which must be on or before the scheduled sale day. (For example, to bid in a Monday

auction, an ACH/Electronic Debit payment equal to five percent (5%) of the anticipated final bid or $200

must be completed by 5:00 p.m. on the preceding Tuesday.) A refund of unused ACH deposits will

be

automatically initiated on the 85th day following a deposit. If you are interested in

bidding on a

property beyond that time period, it is your sole responsibility to submit a

new deposit at least three

full business days before the auction in which you intend to participate.

If you submit your deposit directly to the Clerk's Tax Deed department, it must be paid by money order

or cashier's check. This type of deposit must be presented to the Tax Deed Department by 4:00 p.m. the

day before the scheduled auction.

All checks must be drawn upon a U.S. banking institution, made payable to Clerk and Comptroller,

St.

Lucie County. The Tax Deed Department is located at 2300 Virginia Ave., Ft. Pierce FL,

34982.

Under no circumstances will the Clerk accept credit card, personal checks or third party checks. No

deposits will be accepted on the day of the auction. The Clerk's Office cannot guarantee the delivery

date of deposits sent by mail. Bidders are encouraged to submit funds in person to ensure deposit

requirements are met.

Note: If a deposit is made at the Clerk's office by cashier's check, the name and

address of the person

or entity shown as the remitter on the check will be the person or entity that will receive the credit

for the deposit online. That person or entity must be registered with the same name and address on the

online system. For example, if the check shows a corporate name and address, that corporation must be

the registered user on the online system under the same name and address to be given the credit for the

deposit. If a bidder wishes to submit and receive credit for deposits from various sources, they must

make their deposits via ACH.

Foreclosure & Tax Deed Auction FAQ

|

|

An ACH debit is an electronic funds transfer from your bank account, initiated by the Clerk with your

prior authorization. For more information on ACH, please visit the NACHA, the Electronic Payments

Association, at www.nacha.org.

Funds must be drawn from a US financial institution. Some types of money market, brokerage, and/or trust

accounts cannot accept ACH debits. Please check with your financial institution prior to initiating

payment on the website.

Foreclosure & Tax Deed Auction FAQ

|

|

The difference between the successful bidder's deposit and the total amount due must be

received by the

Clerk by 2:00 pm on the next business day after the sale. If payment is made by

certified check, a

separate check must be received for each property purchased. The Clerk cannot accept final payment for

multiple properties on one check.

Foreclosure & Tax Deed Auction FAQ

|

|

Deposits:

Advance deposits may be made online through the electronic auction website via ACH/Electronic Debit

transfer. Deposits made by ACH/Electronic Debit transfer will not be available for bidding until the 4th

business day after the deposit is made. A refund of unused ACH deposits will be automatically initiated

on the 85th day following a deposit. If you are interested in bidding on a property beyond that time

period, it is your sole responsibility to submit a new deposit at least three full business days before

the auction in which you intend to participate.

Also, the deposit may be paid by money order or cashier's check. The remitter on deposits made by

cashier's check must be the registered bidder with the same name and address on the online auction

site.

Final Payment:

Final payment may be made by cashier's check or wire transfer. Final payment must be received by the

Clerk by the 2:00 pm deadline the business day following the sale.

All checks must be drawn upon a U.S. banking institution, made payable to Clerk and Comptroller, St.

Lucie County. The Tax Deed Department is located at 2300 Virginia Ave., Ft. Pierce FL, 34982.

If final payment is made via wire transfer, in order to cover wire transaction fees, the Clerk requires

an additional $5.75 ($5.00 for wire fee and $.75 for postage) to be included in the total amount due.

The sale will be forfeited if the full amount is not received.

If payment is made by cashier's check, a separate check must be received for each property purchased.

The Clerk cannot accept final payment for multiple properties on one check.

The following forms of final payment are NOT accepted:

- Personal check

- Credit cards

- Third party cashier's check

- ACH payment

Foreclosure & Tax Deed Auction FAQ

|

|

If you fail to make the final payment by 2:00 pm the business day following the sale, you will forfeit

your deposit. In the event of forfeiture, the Clerk assesses a non-refundable Clerk fee, a

non-refundable electronic online auction fee and other costs (e.g., re-publication costs) from the

forfeited deposit. Any remaining funds from the forfeited deposit shall be applied toward the opening

bid on the rescheduled sale.

Foreclosure & Tax Deed Auction FAQ

|

|

You may choose to keep your deposit on account with the Clerk to use for future auctions or you may

request a refund of some or all of your remaining deposit. To request a refund, log in and go to "My

Payments". There you will find a link to "Request Refund". If you funded your deposit account via ACH

(electronic debit) you will be refunded via ACH (money will be returned to the same account from which

it was paid). If you funded your deposit account directly with the Clerk, you will receive a refund

check issued by the Clerk. You can check on the status of your refund check by contacting the Clerk's

Office directly.

A refund of unused ACH deposits will be automatically initiated on the 85th day following a

deposit. If

you are interested in bidding on a property beyond that time period, it is your sole

responsibility to

submit a new deposit at least three full business days before the

auction in which you intend to

participate.

Foreclosure & Tax Deed Auction FAQ

|

|

Click here to visit the Tax Deeds

page

Foreclosure & Tax Deed Auction FAQ

|

|

Sales are typically scheduled on Mondays. See the Auction

Calendar for the exact dates of upcoming sales. Bids are accepted beginning at 8 a.m. on

scheduled sale days.

Foreclosure & Tax Deed Auction FAQ

|

|

You can obtain a list of tax deed file numbers for a particular sale on the online auction site. You may

also obtain a list of tax deed file numbers scheduled for a particular sale from the Clerk's public

records.

Foreclosure & Tax Deed Auction FAQ

|

|

The Clerk's Administrative Policy, "Clerk's Tax Deed Sales Procedures," contains information on the tax

deed sales procedures. The policy can be downloaded from the homepage of the online auction site or the

Clerk's website. The Clerk's tax deed

sales page also contains general information on the Clerk's tax

sales.

Foreclosure & Tax Deed Auction FAQ

|

|

There are no fees to participate in the online sale. If you are the winning bidder, you must pay in

addition to your final bid the following costs: documentary stamp taxes ($.70 per $100 or fraction

thereof of the amount bid) and recording fees. You may also be required to pay the cost of postage for

the tax deed to be mailed to you. Recording fees will vary for each tax deed.

Foreclosure & Tax Deed Auction FAQ

|

|

If tax certificates exist or if delinquent taxes accrued after the filing of the tax deed application,

the amount required to redeem such tax certificates or pay such delinquent taxes must now be included in

the opening bid. Therefore, the redemption amount and the opening bid are subject to change without

notice. Call the Tax Collector at 772-462-1650 to get the current redemption amount. The opening bid is

available on the RealAuction or by calling our Tax

Deeds Department at 772-462-6926.

Foreclosure & Tax Deed Auction FAQ

|

|

- Rescheduled - means the property is canceled for the current sale and will be

rescheduled for a future sale.

- Redeemed - means the property was redeemed and will not go to sale.

- Pulled from Sale – means the property was removed from the sale and may be

rescheduled for another sale.

- Bankruptcy – means the property was removed from the sale due to a bankruptcy

filing.

- Applicant Canceled - means the property was removed from the sale by the applicant.

Foreclosure & Tax Deed Auction FAQ

|

|

Deposit funds may be used to bid on multiple sales as long as funds are sufficient to cover 5% of the

maximum combined bids. Deposit funds will be allocated to the properties in the order the bids were

placed. The funds will be returned to your deposit account and will be available for additional bidding

if you are not the successful bidder on a property.

Foreclosure & Tax Deed Auction FAQ

|

|

No, Lands Available properties cannot be purchased online. For more information regarding purchasing

Lands Available properties or call the Clerk's office at 772-462-1476.

Foreclosure & Tax Deed Auction FAQ

|

|

Certificate holders will not be required to register unless they intend to bid over the opening bid. If

the certificate holder intends to bid over the opening bid, they must register prior to the auction and

will be subject to the advance deposit requirements. See the Clerk's Administrative Policy, "Clerk's Tax

Deed Sales Procedures," for additional information.

Foreclosure & Tax Deed Auction FAQ

|

|

If no bids are received for a property above the opening bid, the property shall be sold to the

certificate holder, who shall pay to the Clerk any amounts included in the opening bid in excess of the

amounts they have previously paid plus the documentary stamp tax and the recording fees due. Payment

from the certificate holder must be received within thirty (30) days after the sale and must be made by

Cash or Cashier's Check. Upon payment, a tax deed shall be issued and recorded by the Clerk.

If payment is not received from the certificate holder within thirty (30) days after the sale, the Clerk

shall immediately enter the land on a list entitled “Lands Available for Taxes”.

Foreclosure & Tax Deed Auction FAQ

|

|

A guardianship is a legal proceeding in the circuit courts of Florida in which a guardian is appointed

to represent (protect) the rights of a minor or incapacitated person.

Guardianship FAQ

|

|

A guardian is a person who has been appointed by the court to act on behalf of a ward’s person (Guardian

of Person) or property (Guardian of Property), or both (Guardian of Person and Property).

Guardianship FAQ

|

|

An incapacitated person is a person who has been determined by the court to lack the capacity to manage

at least some of their property or to meet at least some of the essential health and safety requirements

of that person.

Guardianship FAQ

|

|

A person petitions the court to determine another person’s incapacity and simultaneously petitions the

court to appoint a guardian for that person. The court appoints an attorney to represent the alleged

incapacitated person if they do not have private counsel. A committee appointed by the court examines

the individual and reports their findings to the court. The court either dismisses the petition or

schedules a hearing to determine the partial or total incapacity of the individual.

If the court determines the person to be incapacitated, a guardian is usually appointed for the

incapacitated person.

Guardianship FAQ

|

|

Managing the property of the incapacitated person, including:

- Taking inventory of the property

- Investing prudentially

- Using financial proceeds for the persons’ support

- Filing detailed reports with the court each year

- Obtaining court approval for certain financial transactions

Guardianship FAQ

|

|

Handling the responsibilities delegated in court for the person, such as:

- Providing medical, mental and personal care services

- Determining the residential setting best suited to the person

- Presenting a detailed plan to the court each year for the care of the incapacitated person

Guardianship FAQ

|

|

The court may re-examine the person and restore some of his / her rights if the person has partially or

fully recovered or when a minor reaches the age of majority.

Guardianship FAQ

|

|

Please call Legal Aid of Palm Beach County at 561-655-8944.

Guardianship FAQ

|

|

You must complete and submit an Application for Criminal Indigent Status. Each section must be answered.

There is a $50.00 fee for each application filed.

Indigency FAQ

|

|

Apply in person at one of three locations:

Main

Office

201 South Indian River Drive

Payment Center, 2nd Floor

Fort Pierce, FL 34950

Hours: Monday - Friday 8 A.M. - 5 P.M.

(Excluding Holidays)

St.

Lucie West Annex

(South County Courthouse)

250 N.W. Country Club Drive

Port St. Lucie, FL 34986

Hours: Monday - Friday 8 A.M. - 5 P.M.

(Excluding Holidays)

Apply by Mail

Clerk and Comptroller, St. Lucie County

Attn: Payment Center

P.O. Box 700

Fort Pierce, FL 34954

Apply by Email

Email your application to: [email protected].

Indigency FAQ

|

|

The $50 application fee was created by the legislature. The fee applies whether or not you actually are

appointed a public defender. Statue requires payment of the $50 fee to the Clerk and Comptroller, St.

Lucie County within seven (7) days. If the fee is not paid within the seven (7) days, it will be

assessed against you at the conclusion of this case.

Indigency FAQ

|

|

Applicants for indigent status are approved or denied based on the guidelines provided in Florida

Statutes for indigent determination.

Poverty guidelines are provided by the State and updated each January. If you do not agree with the

determination made by the Clerk’s office, you may seek judicial review.

Indigency FAQ

|

|

If you apply in person, a Deputy Clerk will review the application and will provide a letter of approval

or denial. Otherwise, letters of approval or denial are mailed to the address listed on the indigent

application.

Indigency FAQ

|

|

Once you receive notification that your application is approved, please wait three business days to

contact the Public Defender's office at 772-462-2048 to make an appointment to discuss your case.

Indigency FAQ

|

|

You will sign the bottom of the application in the appropriate area indicating you wish to seek judicial

review at your next scheduled court hearing.

Indigency FAQ

|

|

No. The provision of a public defender and/or costs/due process services are not free. A judgment and

lien may be imposed against all real or personal property you own to pay for legal and other services

provided on your behalf or on behalf of the person for whom you are making this application. Under

Florida Statute 55.10 the judgment is recorded in the Official Records to create a lien, and do accrue

statutory interest. Pursuant to Florida Statute 938.30, you are responsible for payment of such

judgment. If your case is dismissed or you are acquitted, no fees are due.

Indigency FAQ

|

|

Jurors must be 18 years of age or older, a citizen of the United States, a legal resident of Florida,

and reside in the county in which they are called to serve.

Jury Duty FAQ

|

|

Disqualifications from serving as a juror are as follows:

- Any person convicted of a felony (unless their civil rights have been restored)

- Any person convicted of bribery, forgery, perjury, or larceny

- Any person under prosecution for any crime

- The governor, lieutenant governor, cabinet officers, clerks of court, or judges

- Any person with an interest in any issue to be tried (e.g., family members, victims, etc.)

- Any person determined to be mentally incompetent

- No longer a resident of St. Lucie County

- Non US Citizen

Jury Duty FAQ

|

|

Exemptions from serving as a juror are as follows:

- 70 years old or older. Please note if you would like to be permanently excused.

- Full-time high school or college student, 18 - 21 years old

- Expectant mother or a woman who has given birth within six months before the report date.

- Parent not employed full-time with a child under 6 years old

- Physically unable to serve (Download Medical Request Excusal Form)

- Served as a juror in St. Lucie County within the last 12 months. Please include the date last served.

- Sole unpaid caregiver of a person who is incapable of caring for himself/herself because of physical and/or mental illness

Jury Duty FAQ

|

|

Yes, at the judge's discretion:

- Practicing attorneys

- Practicing physicians (more often postponed to a more convenient time or assigned to panels for

one-day trials)

- Any person who is physically infirm in a manner consistent with the Americans with Disabilities Act

(ADA)

- Any person expressing a hardship, extreme inconvenience, or public necessity

Jury Duty FAQ

|

|

Yes, Section 40.23, Florida Statutes, allows postponements of jury service to be made for up to six months.

Jurors are allowed two postponements, the third postponement requires written documentation by fax, email, or mail. Typical postponements are between four and six months depending on availability. If you want to postpone your service, please email your request along with your Candidate/Juror Number to the Jury Department at [email protected], fax it in at 772-462- 2124, or contact our office at 772-462-6983. One of our Jury Clerks will get back to you within 2-3 business days.

Jury Duty FAQ

|

|

Yes, you may.

Jury Duty FAQ

|

|

Jurors who are not regularly employed or who do not continue to receive regular wages while serving as a

juror are entitled to receive $15 per day for the first 3 days of juror service. Further, each juror who

serves more than 3 days is entitled to be paid by the State of Florida for the fourth day of service and

each day thereafter at the rate of $30 per day of service.

Jury Duty FAQ

|

|

No, they are not.

Jury Duty FAQ

|

|

No, they are not.

Jury Duty FAQ

|

|

Willful failure to respond to juror summons is a contempt of court, punishable by up to $100 in fines

and possible incarceration in a local jail for a period to be determined by the presiding judge.

Jury Duty FAQ

|

|

Please dress in keeping with the importance and dignity of your position as a juror. Business or business casual attire is appropriate. You may want to bring a jacket or sweater as courtrooms are often cool.

Jury Duty FAQ

|

|

Vending is available for purchase via credit card and is located outside the Jury Room; however, all food must be consumed inside the Jury Room.

Jury Duty FAQ

|

|

Yes, there is free Wi-Fi inside the Jury Room.

Jury Duty FAQ

|

|

You were randomly selected for jury service from the Florida Highway Safety and Motor Vehicles list of licensed drivers and ID holders. The right to a trial by jury is a fundamental American principle guaranteed by the Constitution. It is the duty of every citizen to serve when called upon to do so. FAILURE TO APPEAR may render you liable to arrest and a fine of up to $100.00 for contempt of court. (s.40.23, Fla. Stat.)

Jury Duty FAQ

|

|

If you receive a summons to report for jury service and you are a limited English speaker, you will still need to report to the courthouse as instructed by your jury summons. Jury staff does not have the authority to excuse you from your jury service. In the courtroom, the judge will inquire whether any jurors have issues understanding the English language and the judge will determine whether you can be excused from your jury service. If you are summoned in the future and a judge has previously excused you from jury service due to limited English understanding, you will still need to report for jury service. A judge must make a determination each time a juror is summoned whether they can be excused based on language issues.

Jury Duty FAQ

|

|

If you failed to report for jury service, please contact the Jury Department via email at [email protected] as soon as possible. One of our Jury Clerks will get back to you within 2-3 business days to reschedule your report date, you will not receive a fine or other sanctions.

Jury Duty FAQ

|

|

(a) Contact the Payment Center to set up a payment arrangement or

(b) Attend the Collection Court hearing.

Juvenile FAQ

|

|

(a) If it is your first notice for Collection court, contact the Payment Center to make a payment

arrangement immediately to avoid a second notice.

(b) If a second notice is issued, arrangements are not made, and you do not appear in court, your driver

license could be suspended until all pending cases are paid in full.

Juvenile FAQ

|

|

Appear in person at the Collection Department and provide a Florida I.D. The contract signer must be at

least 18 years of age.

Juvenile FAQ

|

|

In order to reinstate a driver license, court fees on all outstanding cases must be paid in full. At

that time, the Collection Department will issue a release and the guarantor is responsible for taking it

to the DMV to have their driver license reinstated.

Juvenile FAQ

|

|

YES. The Clerk's office cannot excuse anyone from a subpoena or a summons.

Juvenile FAQ

|

|

YES, until they are 18 years old.

Juvenile FAQ

|

|

You may make your payment in person at one of the following locations:

Main

Office

201 South Indian River Drive

Payment Center, 2nd Floor

Fort Pierce, FL 34950

St.

Lucie West Annex

(South County Courthouse)

250 N.W. Country Club Drive

Port St. Lucie, FL 34986

Alternately, you may mail your payment if paying by cashier's check or money order. A $3.50 fee must be

added to restitution payments. Make checks payable to:

Clerk and Comptroller, St. Lucie County

Attn: Payment Center

P.O. Box 700

Fort Pierce, FL 34954

Juvenile FAQ

|

|

Cash, Cashier's Check, Money Order, and Credit Card (MasterCard, Visa, Discover and American Express).

Juvenile FAQ

|

|

NO.

Juvenile FAQ

|

|

YES, if paying by cashier's check or money order. A $3.50 fee must be added to restitution payments.

Make checks payable to:

Clerk and Comptroller, St. Lucie County

P.O. Box 700

Fort Pierce, FL 34950.

Juvenile FAQ

|

|

NO, only the juvenile, legal parent/guardian/custodian, attorney of record or law enforcement officials

can receive case information when appearing in person with proper identification. The armed forces can

receive case information but must also provide a release signed by the child

Juvenile FAQ

|

|

Thirty days are given to pay the $65 Sexting Infraction fee to the Clerk and Comptroller, St Lucie

County. Failure to make payment, within 30 days, will result in the infraction case being set for a

hearing before the Juvenile judge.

Juvenile FAQ

|

|

Yes. Complete the online application

form and a Deputy Clerk will email you instructions to complete the process virtually.

Marriage FAQ

|

|

View marriage license fees and accepted payments on our Fees page.

Marriage FAQ

|

|

Marriage licenses are valid for 60 days. If you are not married within 60 days, you will have to obtain

a new license.

Marriage FAQ

|

|

Yes, a valid passport or identification of home country is accepted in place of SS number.

Marriage FAQ

|

|

The course has to be taken within one year of applying for the marriage license.

Marriage FAQ

|

|

The legal age is 18. If either party is 17 years old, the clerk cannot issue a license unless a

notarized written consent of parent(s) or guardian(s) along with driver license, identification card, or

passport of all parties is presented and filed. However, the license shall be issued without parental

consent when both parents are deceased or when a minor has been previously married.

Marriage FAQ

|

|

Yes, a Florida notary public, regularly ordained ministers and clergy, judicial officers, and Clerks of

the Circuit Court may perform ceremonies.

Marriage FAQ

|

|

Yes, Marriage ceremonies are conducted in person at the downtown Fort Pierce and St. Lucie West offices.

Marriage FAQ

|

|

If you lost your marriage license after you were married, you can obtain a duplicate license. For cost,

please see our Fees page. You must come to our

downtown Fort Pierce office and fill out an Affidavit of

Proof of Marriage. You must also bring along two witnesses that were present at the time the

ceremony

was performed. All parties must have a valid state or federal photo ID.

Marriage FAQ

|

|

If your marriage license has a mistake, you will need an amended license issued by the county Clerk who

issued it. Mistakes may include misspellings, incorrect dates of birth, or Social Security numbers. For

amended license cost, please see our Fees page.

Marriage FAQ

|

|

View the Official Records Search to access a digital

copy of your marriage license. Certified copies may

be purchase by submitting an online Public Records Request or

visiting our downtown Fort Pierce or St.

Lucie West locations. For costs, please see our Fees

page.

Marriage FAQ

|

|

No, when you obtain a license in Florida, it is only valid in the State of Florida.

Marriage FAQ

|

|

The statutory waiting period begins when the applicants take the oath and sign the marriage license.

Marriage FAQ

|

|

It is the Involuntary Examination of someone if there is a reason to believe that the person has a

mental illness. Anyone may fill out this paperwork to submit to the court.

Mental Health FAQ

|

|

It is the Involuntary Assessment and Stabilization of someone if there is a reason to believe that the

person has a substance abuse problem. You must be a relative or you must have 3 un-related parties to

fill out this paperwork to submit to the court.

Mental Health FAQ

|

|

You can file a mental health case at www.myflcourtaccess.com or by visiting the Circuit Civil Department in the Clerk’s downtown Fort Pierce office.

Mental Health FAQ

|

|

Court forms are available on our Forms

page. You may also pick up forms at the Clerk’s downtown Fort

Pierce office.

Mental Health FAQ

|

|

It will take you about 1 hour to fill out the papers in the office. We usually have a court order from

the Judge within a couple of hours. If ordered, the paperwork is then forwarded to the Sheriff’s

Department for the person to be picked up and delivered to a facility. The Sheriff’s Department usually

acts quickly on these types of cases.

Mental Health FAQ

|

|

There is no filing fee for this service.

Mental Health FAQ

|

|

All you will need to bring is a Driver’s License or picture ID. We will provide you with the necessary

forms to complete here in the office.

Mental Health FAQ

|

|

Anyone may file a Baker Act case. For a Marchman Act case, you must be a relative or you must have 3

un-related parties.

Mental Health FAQ

|

|

- You must file a Petition for Change of Name (Minors, Adult or Family) that can be obtained:

- You may choose to hire an attorney.

- You must pay a filling fee; see Fees & Costs for

the current amount.

- You are required to include a set of fingerprints taken by an authorized provider, which will then

be used for a criminal history background check, before the final court hearing. The fee for the

background check is $37.25. Download

Fingerprinting Instructions.

- Your name is officially changed when the judge grants your petition and signs an order.

Name Change FAQ

|

|

No. All names can be changed by completing one form. This should be completed as part of your case.

Name Change FAQ

|

|

The $37.25 is charged by the Florida Department of Law Enforcement (FDLE) and is separate from the

filing fee. The sheriff also charges $20.00 if paid by cash or $20.50 if paid by credit card for the

electronic fingerprinting - private providers may charge more.

Name Change FAQ

|

|

In order to make any changes to a deed, a new document must be prepared and recorded. The Clerk's office

does not provide forms or fill them out. When the new document is completed, it is then brought to the

Clerk's office to be recorded. Recording a new deed may impact your property tax exemptions. Please

visit the Property Appraiser’s

website for more information.

Official Records FAQ

|

|

If the property is owned jointly, a death certificate can be recorded to clear the title. By recording

the death certificate, anyone searching the property can see the person is deceased, and the remaining

spouse is the sole owner. Per Florida statute, the death certificate cannot show the cause of death, and

cannot be altered or covered up.

Official Records FAQ

|

|

All documents are recorded upon receipt. They must then be indexed, verified and scanned to appear on

public records before they are mailed back to the customer. The turn-around time is normally seven to

ten days.

Official Records FAQ

|

|

In the State of Florida, a deed to the land is the deed to your house. Anything you build on the

property becomes a part of the property. There are not separate deeds to the land and to the house.

Official Records FAQ

|

|

Only the owner of the property can sign, per Florida statute. In the case that the owner is a business,

an officer of that business can sign.

Official Records FAQ

|

|

Recording deeds must be cash, certified check, money order, or business check (attorney, etc.). No

personal checks will be accepted. Make checks payable to: Clerk and Comptroller, St. Lucie County, P.O.

Box 700, Ft. Pierce, FL 34954. You must include a self-addressed stamped envelope for the return of the

recorded documents. Anyone may also bring your documents to either the Courthouse.

Official Records FAQ

|

|

Documents can be mailed to the recording department. Always send a self-addressed stamped envelope for

the return of the recorded documents. Anyone can bring documents to the office to be recorded. It does

not have to be you.

Official Records FAQ

|

|

For a list of Recording fees, please view the Fees

page.

Official Records FAQ

|

|

Doc stamps for deeds are $.70 per hundred dollars, rounded off to the next nearest hundred. For example,

$101.00 consideration for a deed would be based on a $200.00 consideration. The recording fee for a one

page deed with a consideration of $101.00, would be $11.40.

Official Records FAQ

|

|

Doc stamps are $.35 per hundred dollars rounded off to the next nearest hundred. Intangible taxes are $

.002 of the actual amount of the mortgage.

Official Records FAQ

|

|

- Main Office

201 South Indian River Drive

4th Floor Recording Department